Calculate fica 2023

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Social Security and Medicare Withholding Rates.

At What Age Can You Collect Social Security As Usa

The tax items for tax year 2022 of greatest interest to most taxpayers include the.

. 2022 Self-Employed Tax Calculator for 2023. A 09 Medicare tax may apply. The FICA withholding for the Medicare deduction is 145 while the Social Security withholding is 62.

Find a Dedicated Financial Advisor Now. The employer and the employee each pay 765. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

These are the Social Security changes to expect in 2023. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. The capital gain calculation for the tax year of 2021 is.

This projection is based on current laws and. Social Security rules on a variety of issues change each year as a result of inflation. The current rate for.

See your tax refund estimate. Over a decade of business plan writing experience spanning over 400 industries. How FICA taxes are calculated.

Normally these taxes are withheld by your employer. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

As a worker theres a limit on the amount of your earnings that are taxed by Social Security. This is known as maximum taxable earnings which shifts on a yearly basis in line. Use this calculator to estimate your self-employment taxes.

To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings. The FICA withholding for the Medicare deduction is 145 while the Social Security withholding is 62.

Since the rates are the same. This means together the. Finally add 8370 and 195750 to get your total FICA taxes.

In 2022 only the first 147000 of earnings are subject to the Social Security tax. The tax year 2022 adjustments described below generally apply to tax returns filed in 2023. For 2023 the trustees estimate that the taxable wage base will be 155100 up 8100 from the current wage base of 147000.

Proceeds R 4 000 000Base cost R 2 500 000 R 400 000 R 2 900 000 Capital gain R 4 000 000 R 2 900 000 R 1 100. Then multiply 135000 by 145 00145 to get your Medicare taxes. The rates remained the same for the 2020 tax year.

Do Your Investments Align with Your Goals. For the 2019 tax year FICA tax rates are 124 for social security 29 for Medicare and a 09 Medicare surtax on highly paid employees. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary.

On the other hand if you make more than 200000 annually you will pay. However if you are. This means together the.

If you earn more. If youve already paid more than what you will owe in taxes youll likely receive a refund. The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000.

Well calculate the difference on what you owe and what youve paid. Ad Being an Industry Leader is Earned Not Given Business Planning Simplified. The employer and the employee each pay 765.

2 or 62 would be applied against the employers payroll tax for that cycle. Calculate how much your employees owe in FICA taxes by multiplying their gross pay by the Social Security and Medicare tax rates. Our free online FICA Tax Calculator is a super easy tool that makes it easy to calculate FICA tax for both those who are an employee and those who are self employed.

2 or 62 would be deducted from the employees gross earnings and would be filed with the IRS. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Employee 3 has 37100 in eligible.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

1uuatajsq55tvm

Hsa Limit Increase For 2023 Means More Opportunities To Build Health Savings Mba Benefit Administrators Third Party Administrator

High Inflation Points To Bigger Social Security Cola In 2023

How Much Could Social Security Benefits Go Up In 2023 Cnet

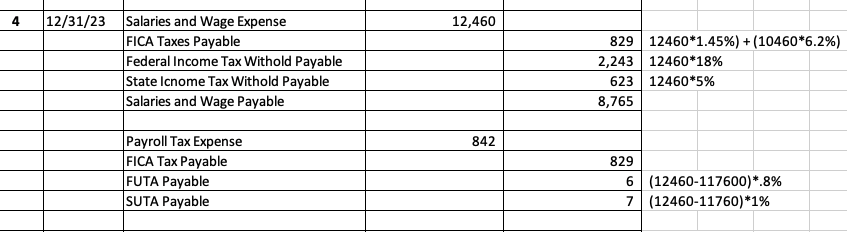

Solved Need Help With A Journal Entry The Journal Entries Chegg Com

2

Nublado Conductor Arriesgado Calculate My Federal Tax El Camarero Inmundicia Editor

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Employee Tax And Benefit Budget For A Retail Company Example Uses

An Employer S Guide To Fringe Benefits Aps Payroll

2

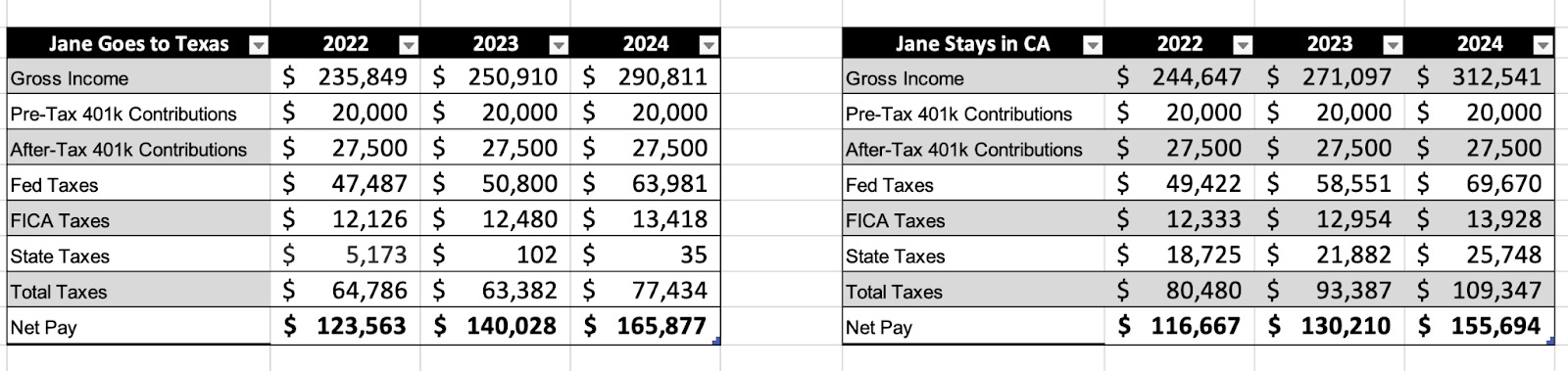

The Real Cost Of A Faang Relocation From California

The Real Cost Of A Faang Relocation From California

High Inflation Points To Bigger Social Security Cola In 2023

Payroll Template Free Employee Payroll Template For Excel

Proposed Fy2022 2023 Operating Capital Budget By City Of Suffolk Virginia Issuu

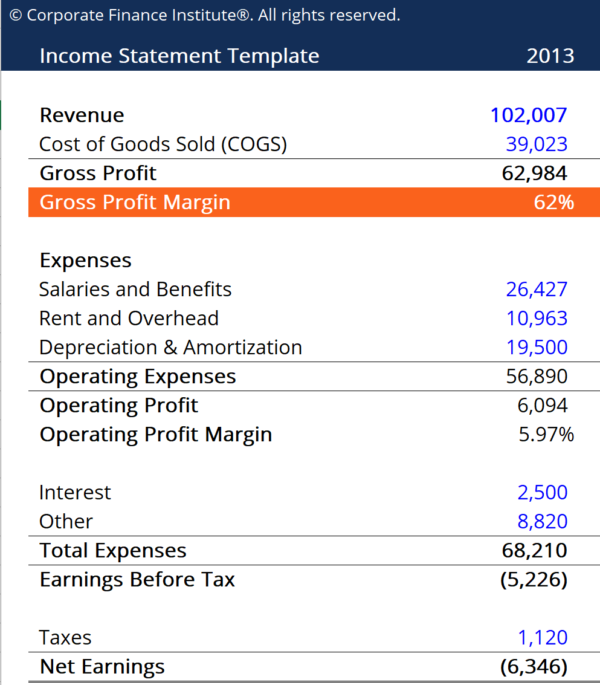

What Is A Profit Loss Statement